von Stefan Heringer

Every investor's dream, often considered the Holy Grail of asset management, is to significantly outperform the market. Traditional thinking holds that this can be achieved in two possible ways: either by gaining more return for the same level of risk or by achieving the same return with less risk.

The brilliant manager is the favorite myth of the financial industry

The fund industry and financial fuel the desire for excess returns through targeted marketing and reporting, showcasing:

- Fund managers who socialize with global boards of directors, acquire first-hand information, and are thus believed to predict the performance of a particular stock more accurately.

- Financial gurus who are credited with having an unerring instinct or intuition.

- Brilliant professors who have developed an equally ingenious algorithm.

- Various ratings, awards, and rankings to guide the poor, unsuspecting investor in choosing the best manager to entrust his assets to.

Is an above-market return a result of skill? No, it's a matter of coincidence!

Such stories give rise to the myth of infallible top funds or experts who supposedly know more or perform better than everyone else. Yet all these strategies share a common fate: sooner or later, they collide with the unforgiving reality of the market, failing to sustain past successes. The crucial question of the matter lies in whether the results are based on skill or mere chance. In other words, are these successes likely to endure? The statistics on this subject are both ruthless and unequivocal.

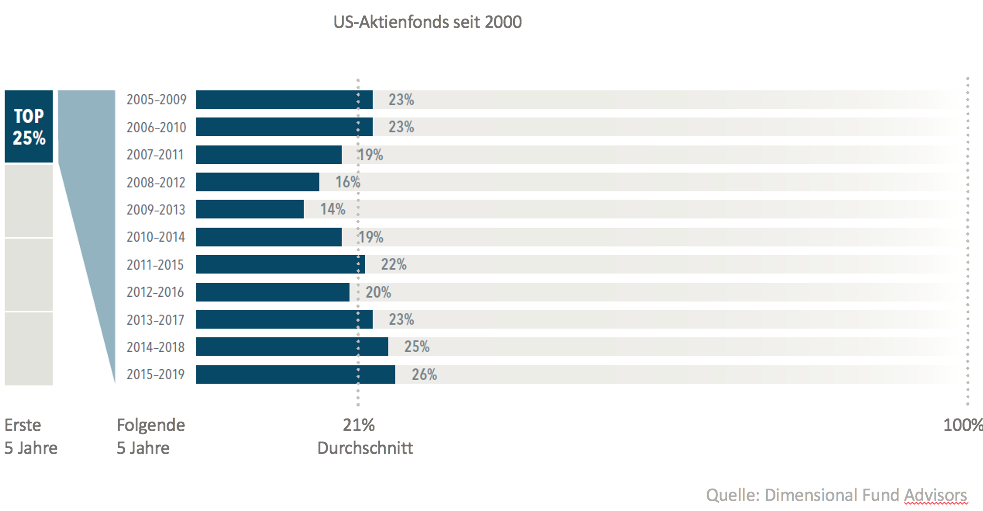

Consider a revealing study from the US:

Active managers are like dice advisors in "Ludo"

The study analyzed the performance of U.S. equity funds over five years, focusing on how the top 25% performed in the subsequent five years. You might expect the best managers to continue their success, or at least to be among the top quartile more often than not. No, on the contrary, the average was only 21%—just below what might occur through pure random distribution. Winners and losers tend to alternate over different time spans, and there's simply no evidence that outperforming in one period correlates with success in another, whether over a time span of one, three, five or ten years. Academic studies on this subject are extensive enough to fill entire libraries. Would you entrust your dice rolls to someone who just beat you in a game of “Ludo”?

Active management is not rational, also during the Corona crisis

This topic has lost none of its relevance in the Corona crisis. With the vast number of active funds, some will have comparatively moderate losses as of today, while some will even profit. These funds will top current rankings and advertise their successes with massive marketing to attract new investor money. It's always the same game...

A fee-based advisor recommending active funds is not a true one.

Avoid the typical investor's mistake of chasing after the top funds of previous years. The likelihood that you'll achieve better results in the long run is vanishingly slim. We are glad to help you maintain a long-term rational perspective and not fall into this trap.

Best wishes,

Stefan Heringer

Forty-nine Fee Counselling

PS: Please feel free to send any questions, criticism or comments to nachdenken@neunundvierzig.com.

Three of our favourite blog posts:

30/05/2020